Managing debtors and creditors is integral to the financial health and success of your business. Debtors refer to customers who owe your business money, while creditors are the suppliers or vendors to whom your business owes money. Both play a significant role in your company’s cash flow and profit margins. Ignoring the importance of managing aged debtors and creditors can result in financial instability, strained relationships, and missed opportunities.

Ensuring your business maintains a positive relationship with debtors and creditors is essential for long-term success. Open communication, transparency, and timely payments ensure a strong reputation and trust between all parties. Additionally, managing aged debtors and creditors can help your business avoid penalties, secure favourable terms, and improve cash flow management.

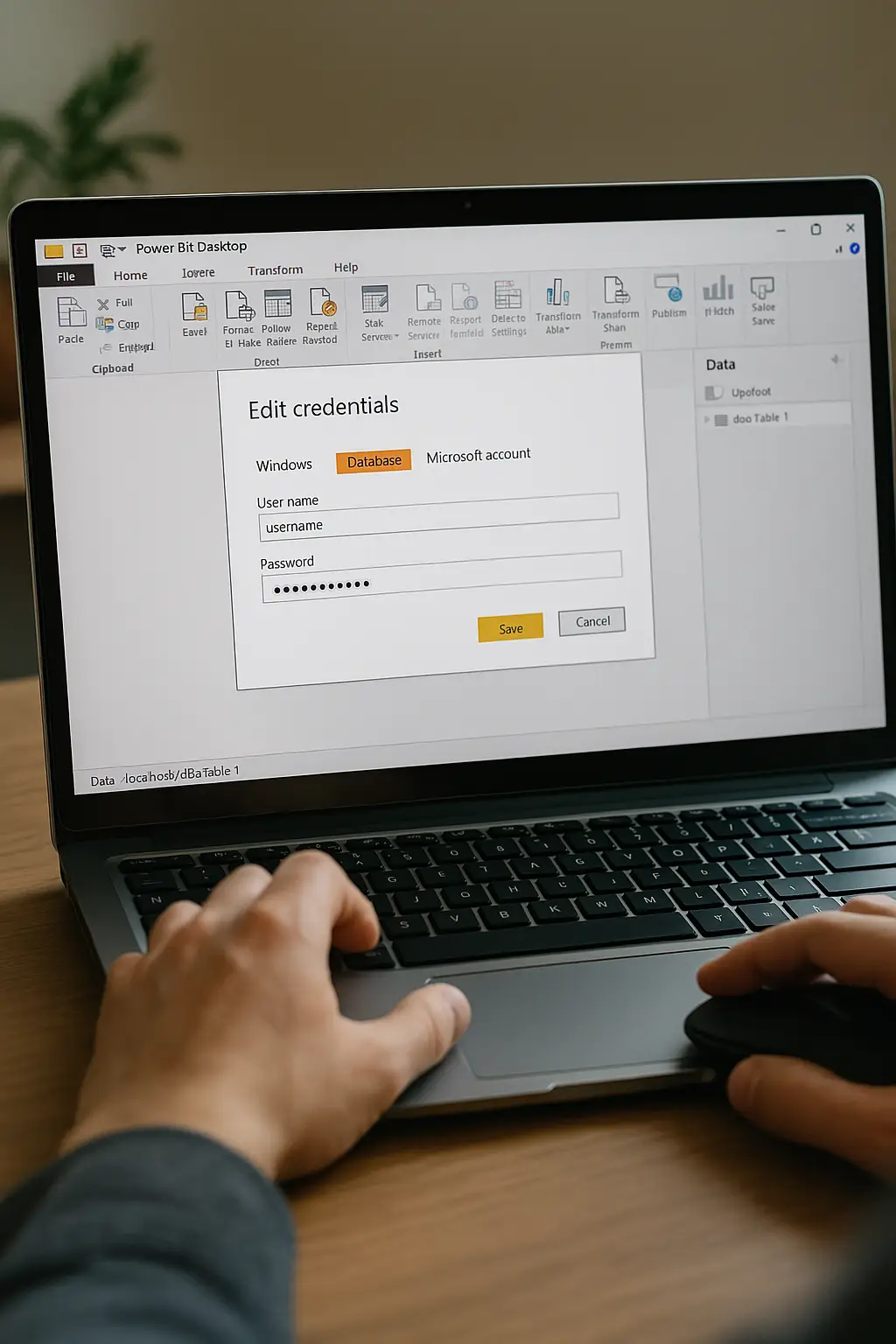

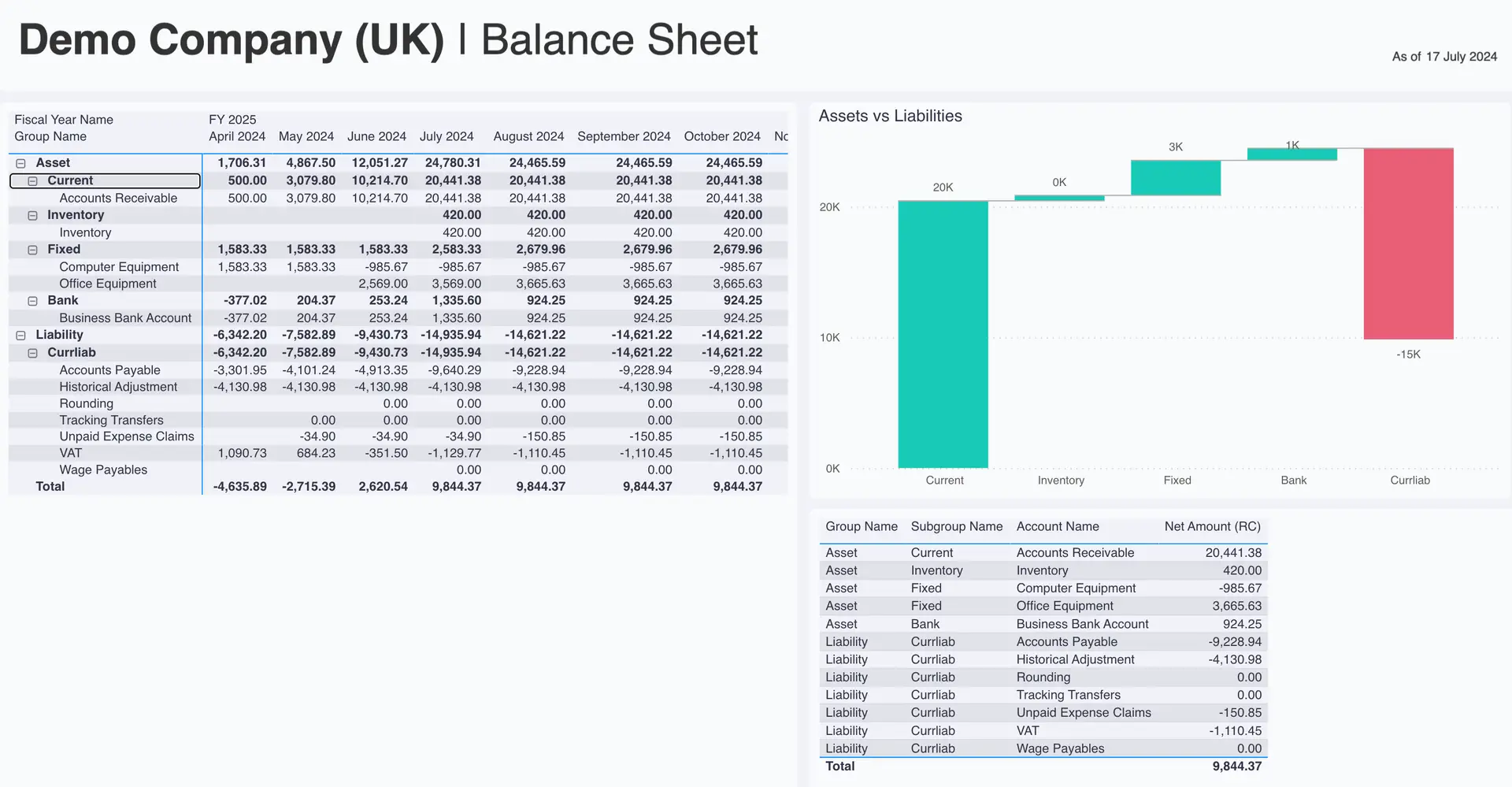

To effectively manage aged debtors and creditors, it is essential to have accurate and up-to-date financial information. This information can be obtained using financial tracking tools and templates such as the Connectorly Power BI template.

Key Takeaways:

- Proper management of aged debtors and creditors is crucial for the financial health and success of your business.

- An efficient system for managing aged debtors and creditors can prevent financial instability, strained relationships, and missed opportunities.

- Good relationships with debtors and creditors require open communication, transparency, and timely payments.

- Using financial tracking tools and templates such as the Connectorly Power BI templates can optimize aged debtors and creditors management.

- The Connectorly for Xero & Power BI offers data visualization, automated reporting, and customizable dashboards to streamline financial tracking.

Introducing the Connectorly Power BI template

If you’re looking for a powerful financial reporting template, look no further than the Connectorly Power BI templates. Created with the needs of businesses in mind, this template is designed to assist with managing aged debtors and creditors effectively, amongst other financial management tasks.

Features and Benefits of the Connectorly Power BI templates

The Connectorly Power BI templates boast multiple features designed to simplify and optimize financial tracking processes. One of its greatest strengths is its ability to provide data visualization, allowing businesses to keep track of their finances at all times. Additionally, automated reporting and customizable dashboards offer further benefits for businesses looking to streamline their financial management on an ongoing basis.

- Identifying creditworthy customers: By analyzing aged debtors data, businesses can identify customers with a history of timely payments. This information can help businesses to allocate resources more effectively and to avoid extending credit to customers who are likely to default. Connectorly helps you by providing information such as client average payment day or client lifetime value.

- Optimizing cash flow: By monitoring aged creditors data, businesses can identify suppliers who are paying their invoices on time. This information can help businesses to negotiate better payment terms and to improve their overall cash flow.

- Managing risk: By analyzing both aged debtors and creditors data, businesses can identify potential financial risks. This information can help businesses to take proactive measures to mitigate these risks and to protect their profitability.

What Makes Connectorly for Xero and Power BI So Effective?

One of the key features of the Connectorly for Xero & Power BI is that it is fully customizable to match your business requirements. Providing a wealth of data on your outstanding receivables and payables can help you forecast and plan your finances more effectively. Connectorly gives you an extended data model based on your Xero data to provide better insights that are tailored to your business specifically, this template ensures that you can make informed decisions that are best suited to your business requirements.